SOP - Calsavers Exemption

Sugam Sharma

CalSavers Exemption — Employer With a 401(k)

Who Qualifies

An employer is exempt from CalSavers if they offer a qualified 401(k) plan to employees.

This includes:

- Traditional 401(k)

- Safe Harbor 401(k)

- Solo 401(k) only if there are no eligible non-owner employees

Step-by-Step: Claiming the Exemption

Step 1: Confirm the 401(k) Is Active

- Plan must be currently active

- Employees must be eligible to participate under the plan terms

- A terminated or frozen plan does not qualify

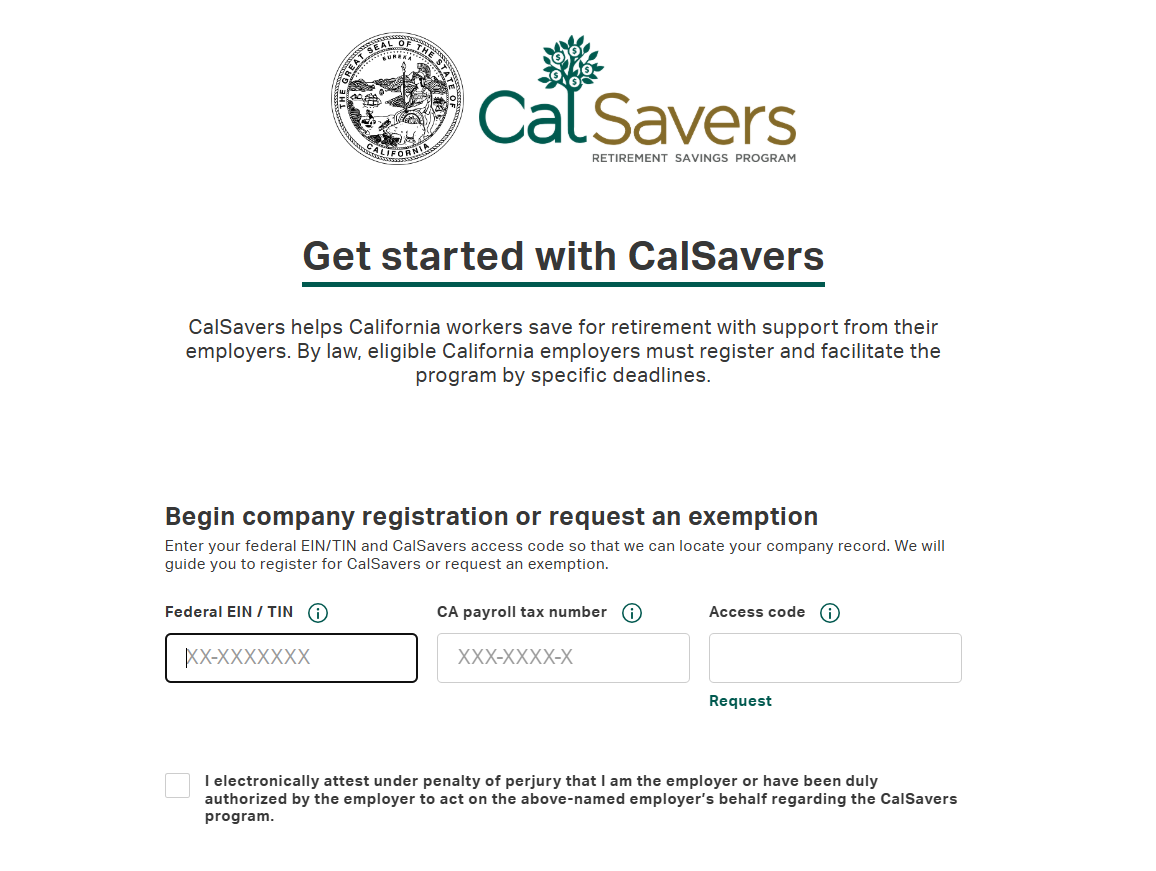

Step 2: Log In to CalSavers

Go to:

https://employer.calsavers.com

Log in or register using:

- Legal business name

- EIN

- California payroll info

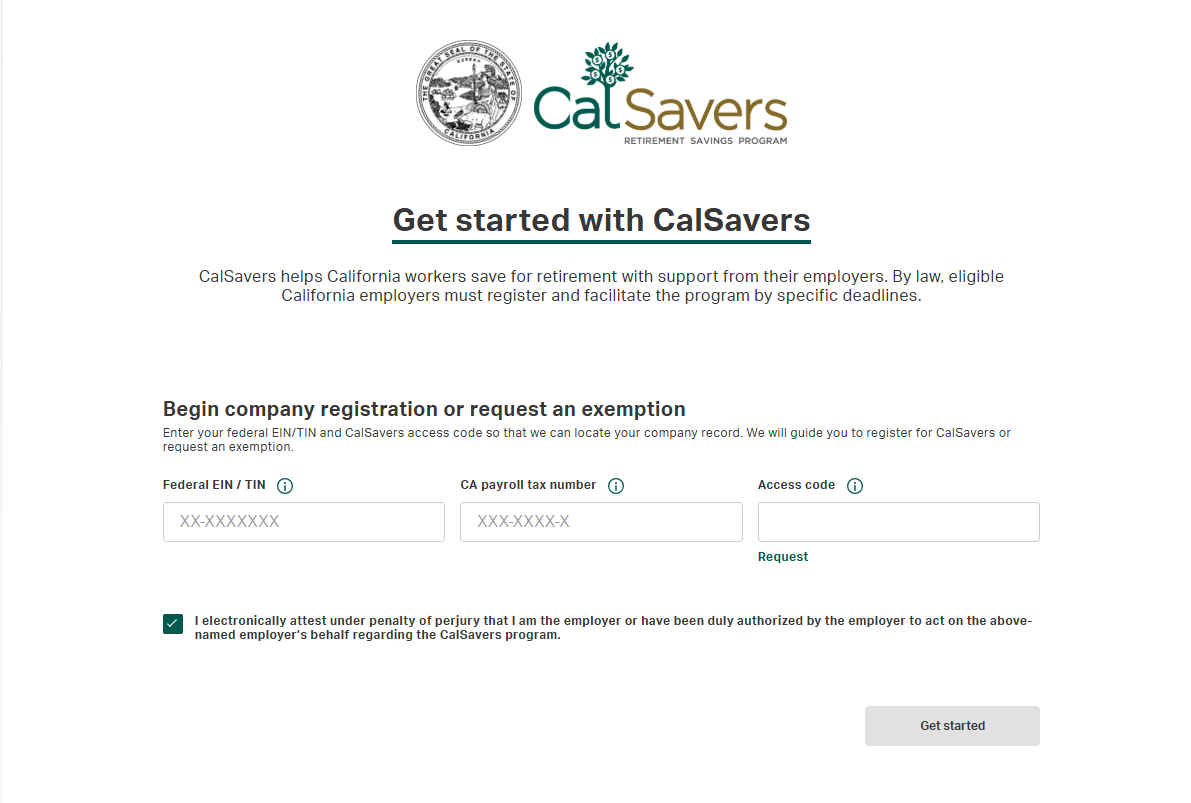

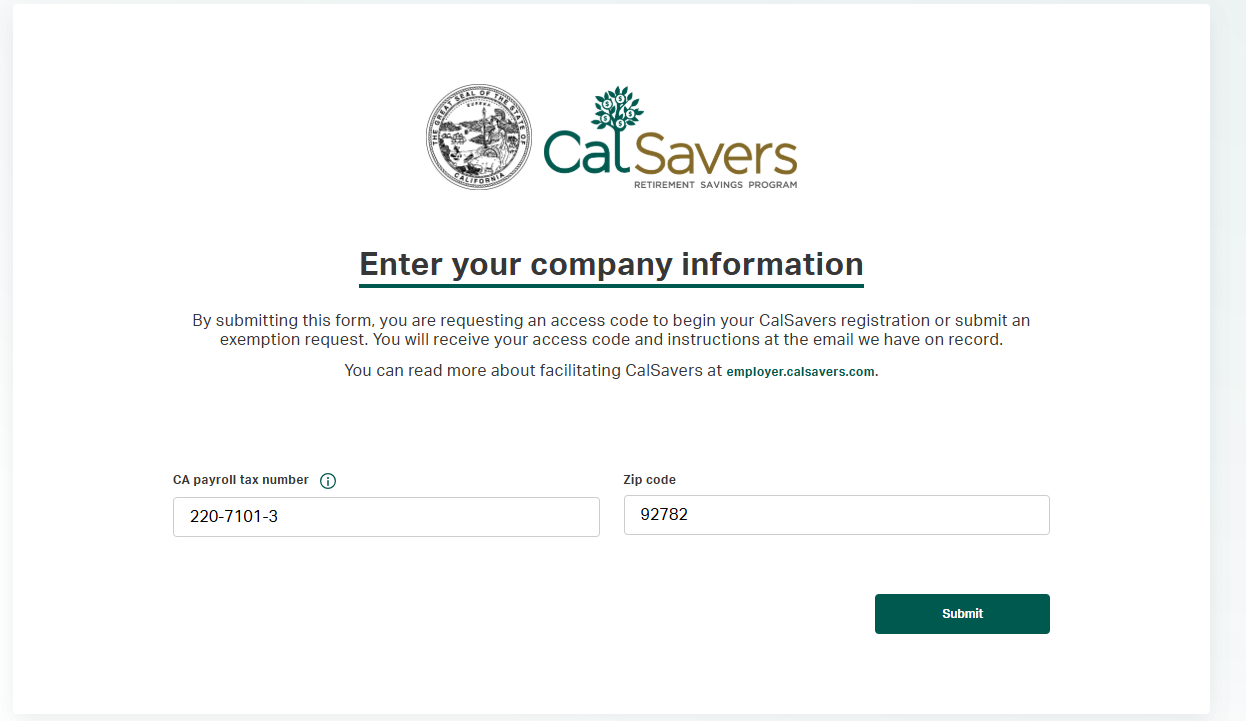

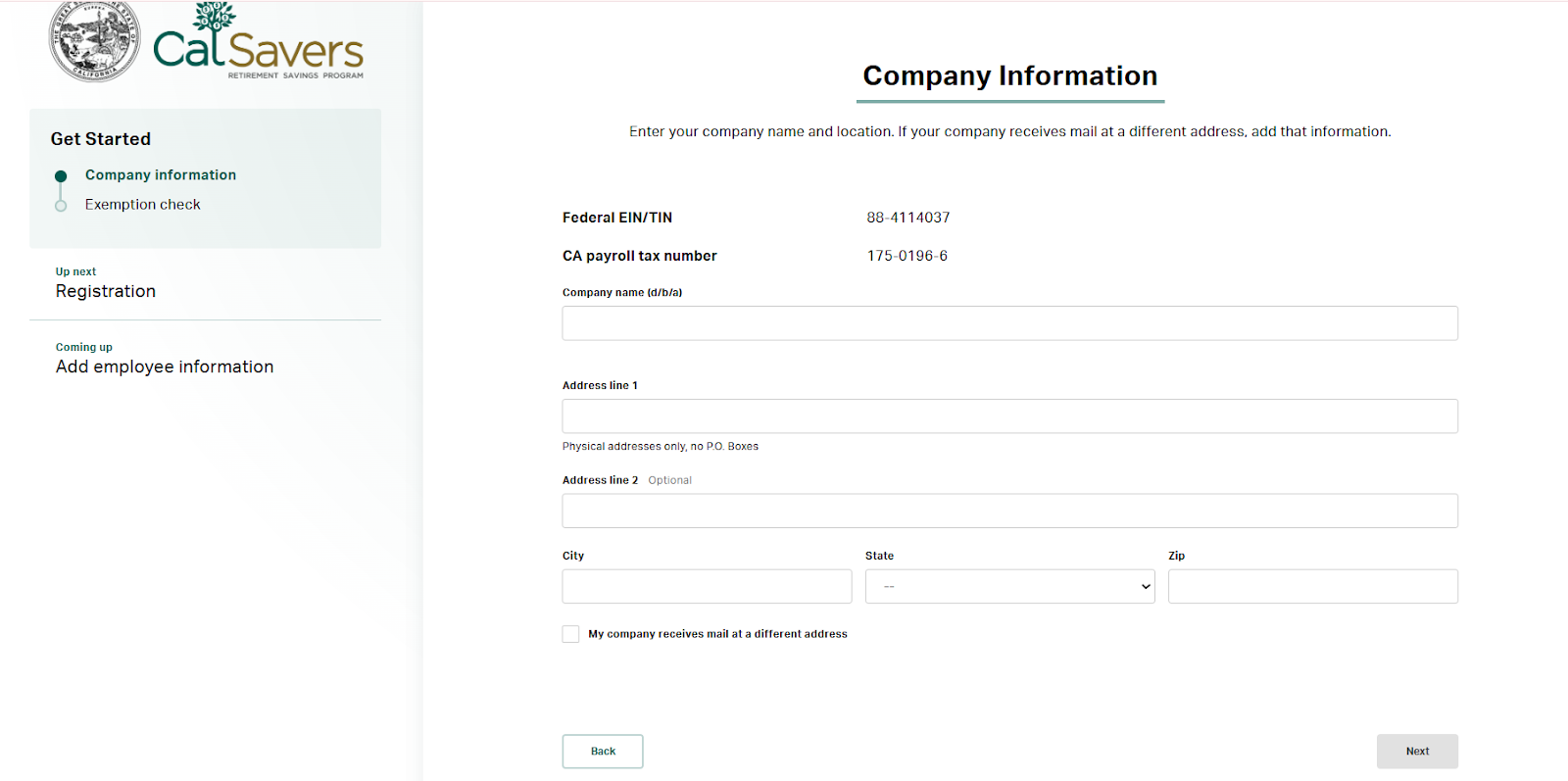

Enter EIN, CA payroll tax number and hit “Request” to get a code.

Enter the information being asked and hit submit

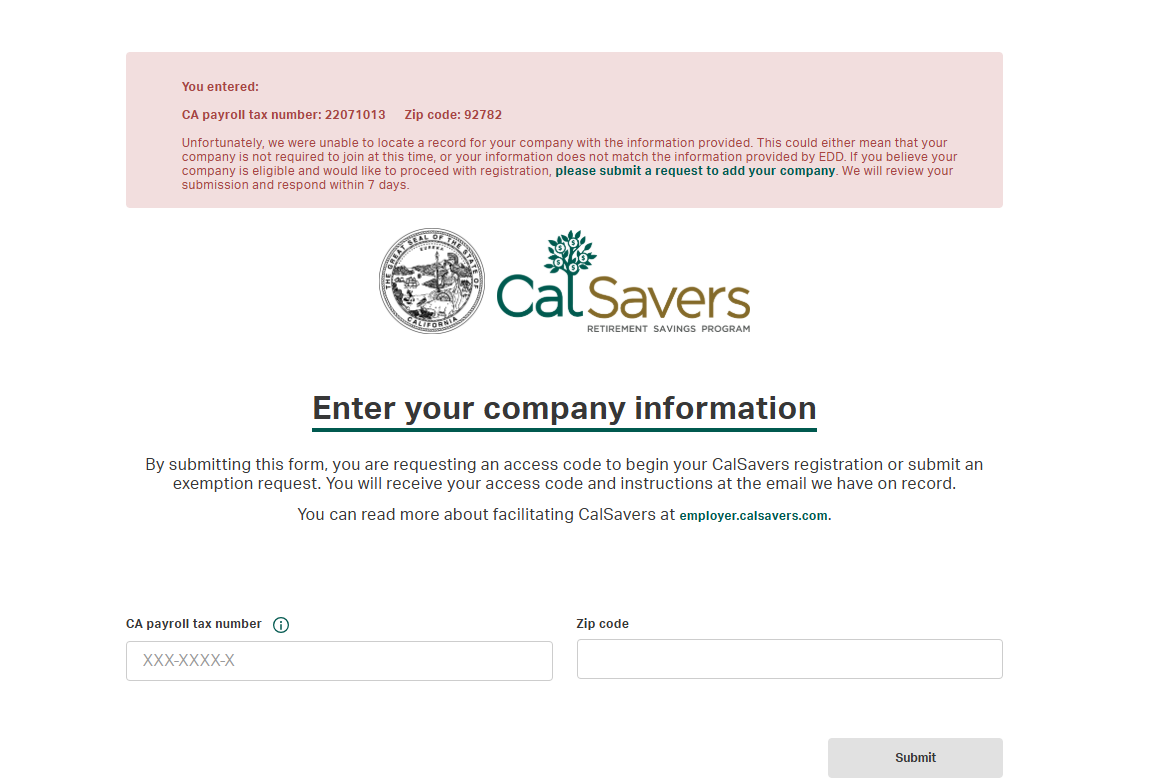

If this error appears please give call to Calsavers to get an access code

-

- Note

:

- See formations documents or previous years Tax return for Federal EIN/TIN

- Note

:

- For Gusto

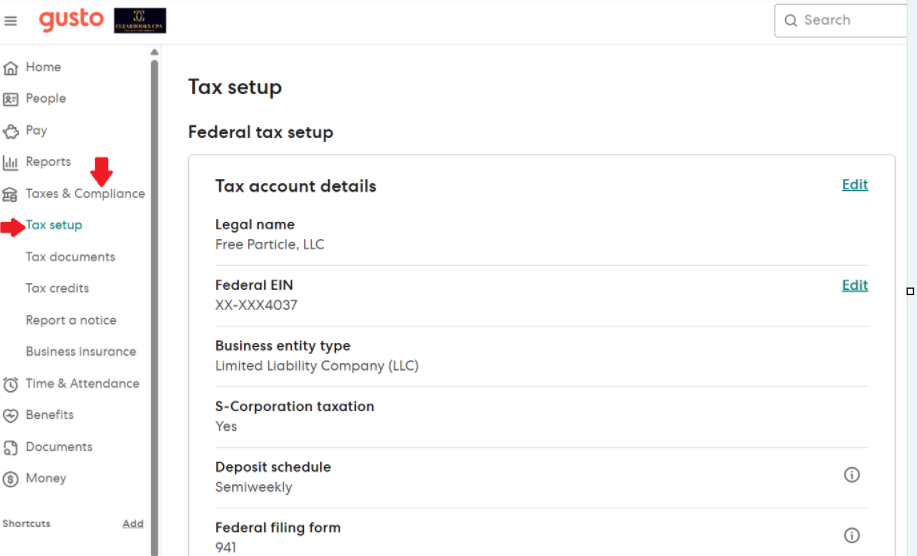

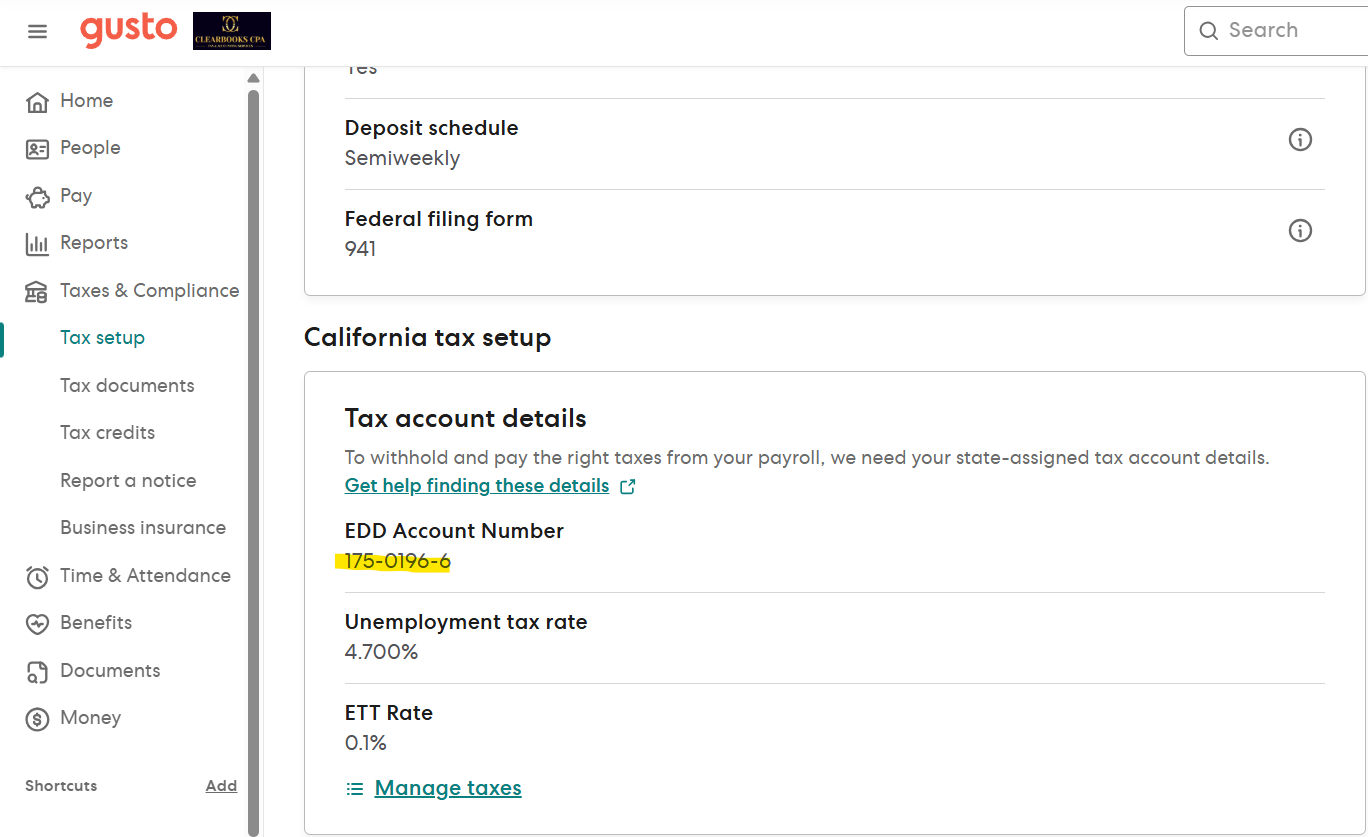

- For CA Payroll tax number go to Gusto → Switch company → Tax & Compliance → Tax Setup

Scroll down to “EDD Account Number” which is CA payroll tax number in Calsavers

- For ADP:

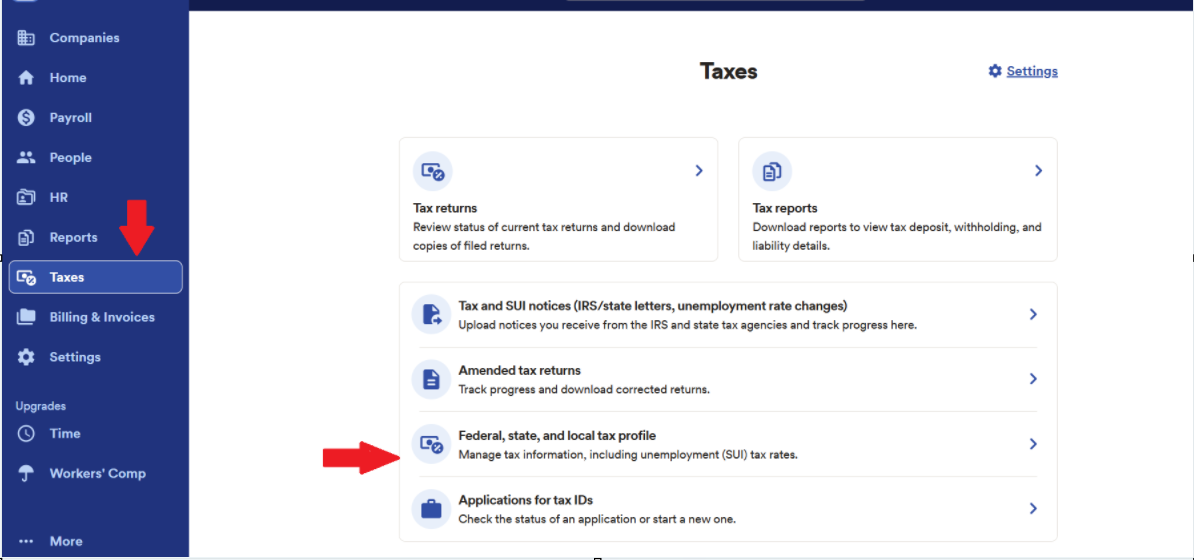

- Log in to ADP → Select company → Taxes → Federal,state, and local tax profile

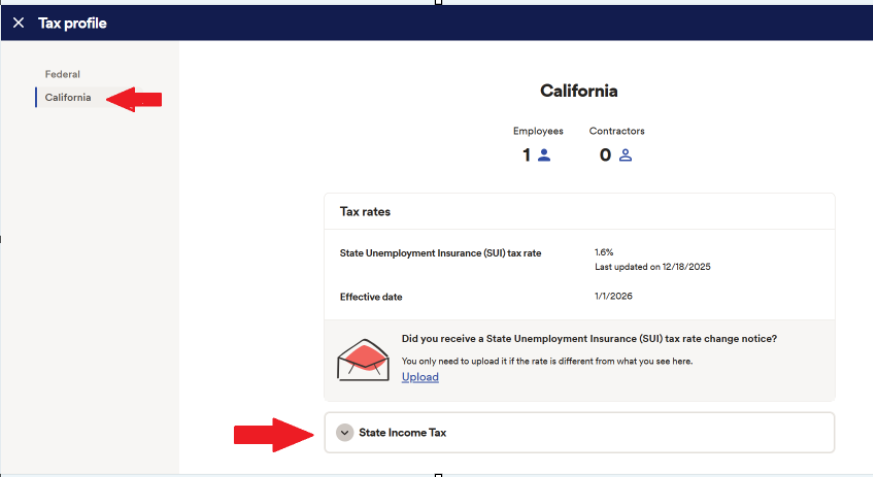

Within Federal,state, and local tax profile → California → State Income Tax

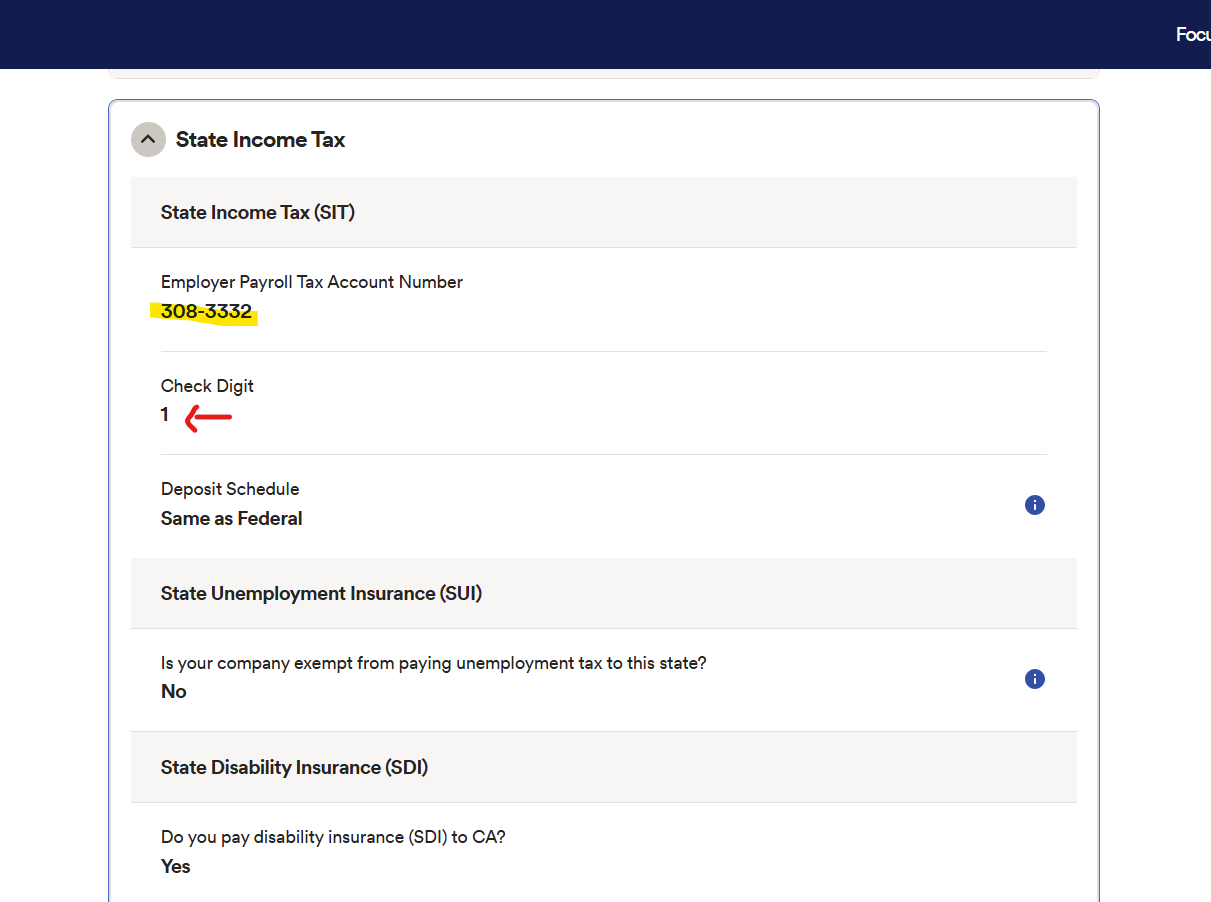

Note : Calsavers requires 8 Digit CA payroll tax number and Employer Payroll Tax Account Number is 7 digits, for last digit use “check digit” for ADP.

- Log in to ADP → Select company → Taxes → Federal,state, and local tax profile

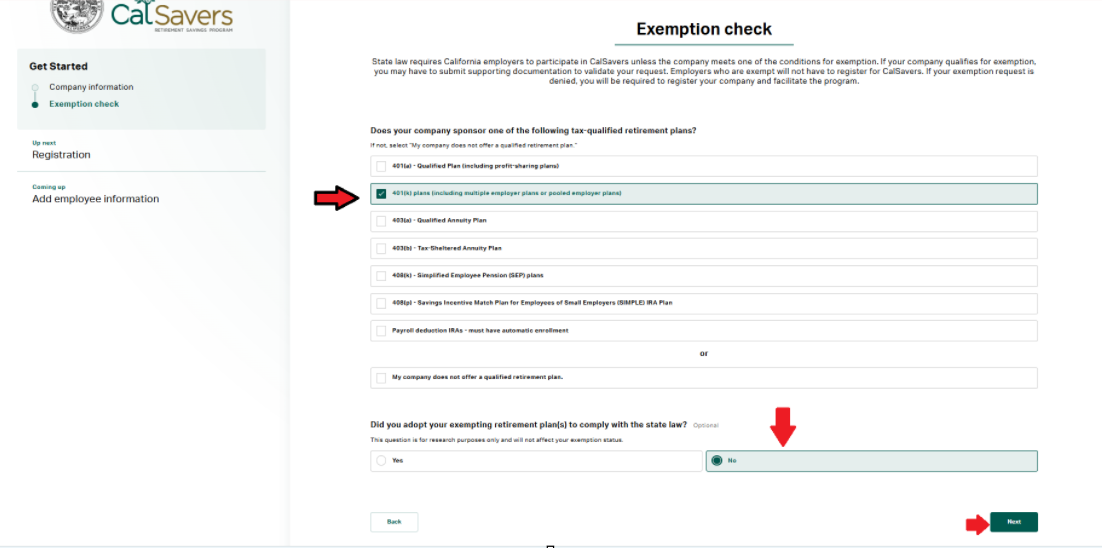

Step 3: Claim Exemption

From the employer dashboard:

- Select “Claim Exemption”

- Choose “I already offer a qualified retirement plan”

- Select 401(k)

from the plan type list

Fill out the Company Information and hit Next-

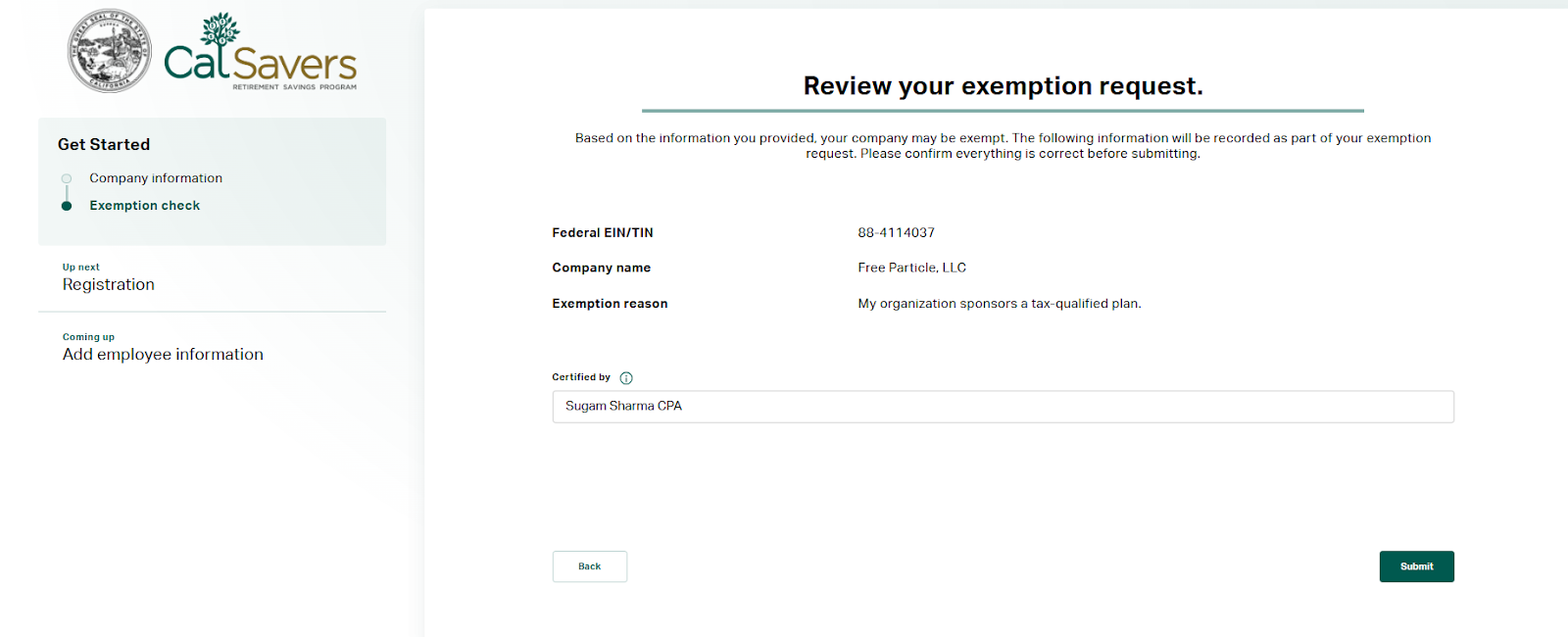

Fill out the representative’s name and hit Submit

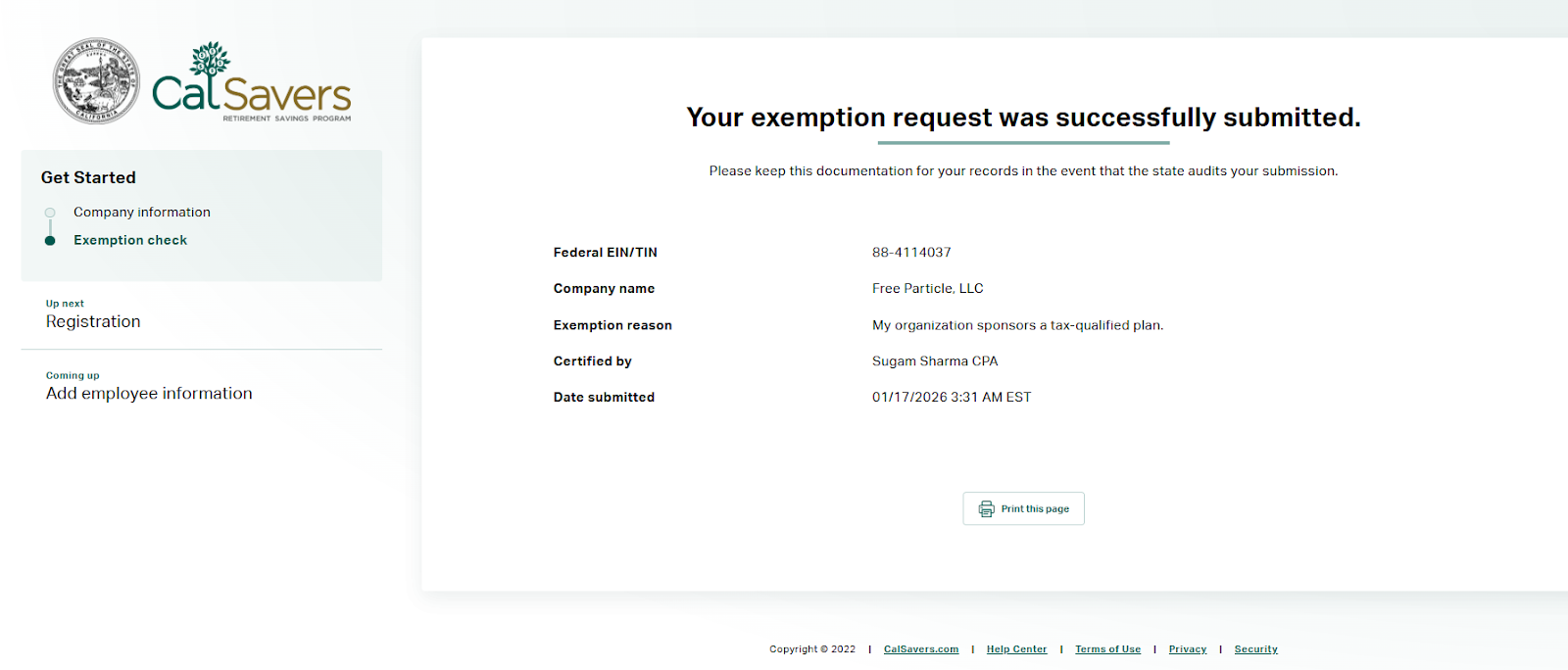

Step 4: Certify and Submit

- Certify the information is accurate

- Submit the exemption

- Save confirmation (email or screenshot)

- Print or save a PDF copy of the completed CalSavers 401(k) exemption confirmation page.

- Upload the confirmation to the client’s respective Google Drive folder (Compliance / Retirement or equivalent).

- Ensure the file name clearly reflects the exemption (e.g., CalSavers 401(k) Exemption Confirmation – YYYY-MM-DD).

- Send an update/confirmation email to the client.

- Include and attach (or hyperlink) the 401(k) exemption certificate/confirmation link in the email for the client’s records.

Contact sales

We’d love to see how we can streamline your hiring together.

Request a demo

Contact sales

We’d love to see how we can streamline your hiring together.

Request a demo

Contact sales

We’d love to see how we can streamline your hiring together.